BlackRock’s iShares Bitcoin Trust ETF makes a significant $970 million Bitcoin purchase, strengthening the market as inflows surge.

BlackRock’s massive $970 million Bitcoin buy on April 28 signals a continued wave of institutional interest, marking a new chapter in Bitcoin’s market recovery. As the world’s largest spot Bitcoin ETF, iShares Bitcoin Trust (IBIT) is playing a pivotal role in boosting Bitcoin’s price, providing “structural support” for its ongoing rally. This latest surge in inflows underscores the growing demand for Bitcoin-backed products, despite retail interest lagging behind.

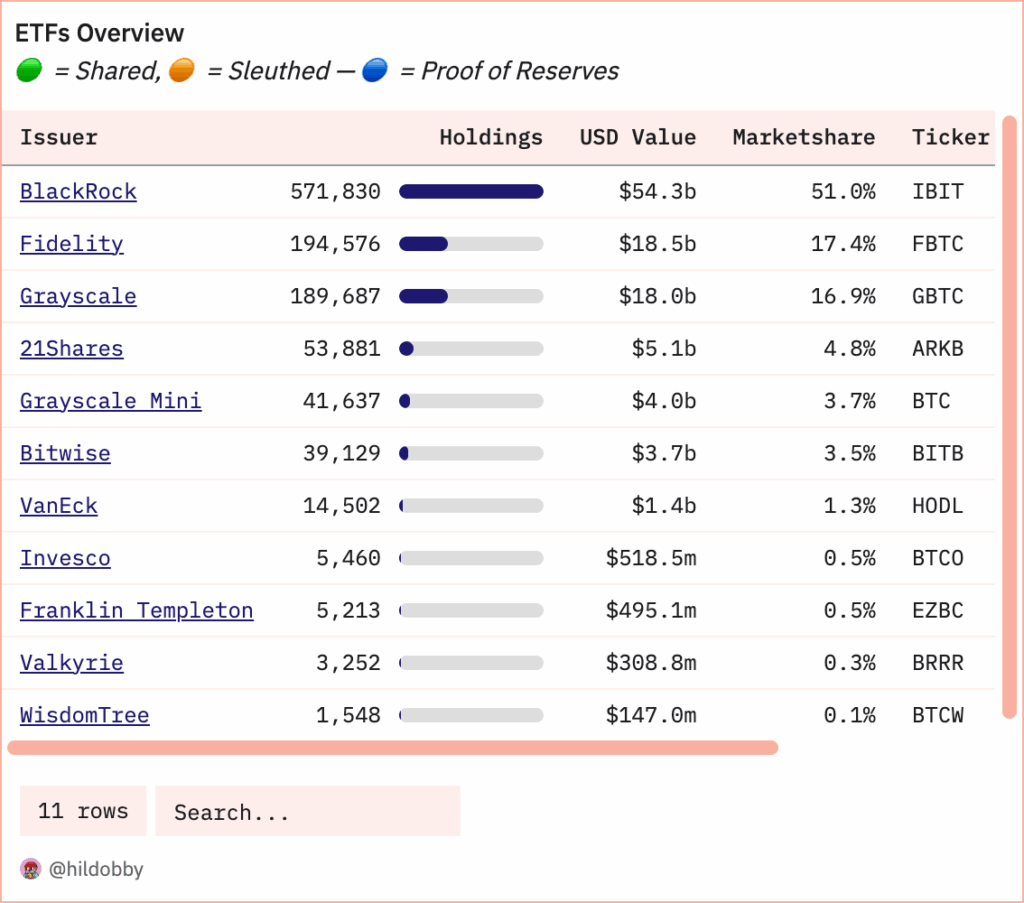

BlackRock’s IBIT ETF, with over $54 billion in assets under management, has now become a dominant force in the Bitcoin market, holding 51% of the total market share for spot BTC ETFs. This recent purchase of nearly $1 billion in Bitcoin brings the total net inflows for US-based spot BTC ETFs to more than $590 million, a stark contrast to other ETFs like ARK Invest’s ARKB, which recorded significant outflows.

The surge in investments is a clear signal of the increasing institutional appetite for Bitcoin, providing a solid foundation for price growth. Market analysts are calling this influx of capital “structural support,” with experts noting that this kind of institutional backing is crucial for sustaining Bitcoin’s upward momentum. As Bitcoin’s price climbs above the $94,000 mark, these ETF inflows are credited with playing a significant role in the cryptocurrency’s recovery, alongside corporate buying activity.

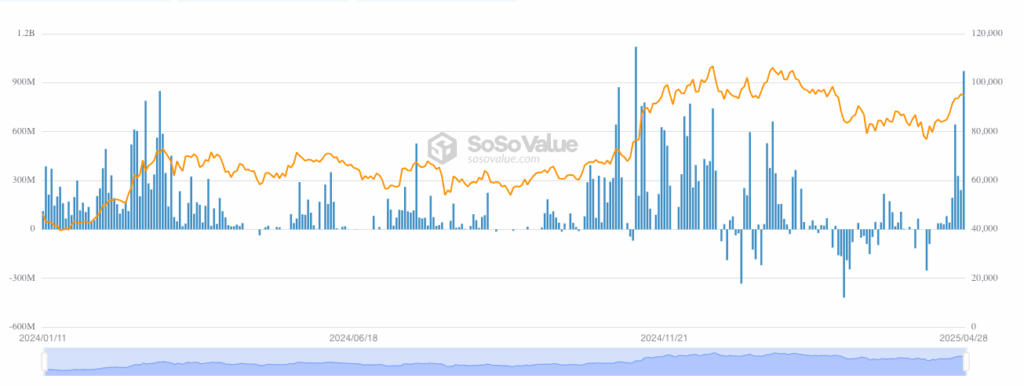

With ETFs like BlackRock’s making large-scale Bitcoin purchases, the market is seeing the second-highest week of investments since their inception in January 2024. The cumulative $3 billion in net inflows is not only bolstering Bitcoin’s price but also reinforcing the broader market sentiment. According to Nexo dispatch analyst Iliya Kalchev, the latest inflows are laying the groundwork for further price gains, with “structural support” playing a crucial role in this momentum.

The influx of funds into BlackRock’s Bitcoin ETF highlights the growing role of institutional investors in the crypto market, offering the support needed for Bitcoin’s continued ascent. With the market showing signs of strength, fueled by ETF investments, Bitcoin’s future remains bright, and analysts predict the next phase of its price rally could be on the horizon.