In every crypto bull run, history repeats itself: 97% of traders walk away with less money than they started with.

Not because they didn’t have the right coins. Not because they didn’t believe. But because the market is a carefully designed trap, and most traders fall for it.

But you don’t have to.

This article gives you the 3-pillar defensive playbook that can place you in the winning 3%. We’ll uncover how institutional giants manipulate the charts and your mindset—and show you how to protect your capital while positioning for long-term gains.

🎭 The Two-Front War: Charts and Psychology

Market manipulation isn’t a conspiracy—it’s a strategy.

Wall Street institutions like BlackRock, JP Morgan, and Fidelity are now playing the crypto game. They’ve dominated traditional markets for decades and brought their manipulation playbook with them.

Their strategy has two fronts:

1. The Chart War

Have you noticed the relentless up-down-sideways motion in this market? That’s not random. It’s engineered to drain your energy and erode your conviction. Most people don’t sell at euphoric tops—they sell at emotional bottoms out of exhaustion.

2. The Mind War

The second front is psychological. They flood media and social platforms with fear and uncertainty: “Crypto is dead.” “Altcoins are trash.” “ETH is over.”

And while you’re panic-selling?

They’re buying.

💼 What the Institutions Are Really Doing

Let’s talk facts—not headlines.

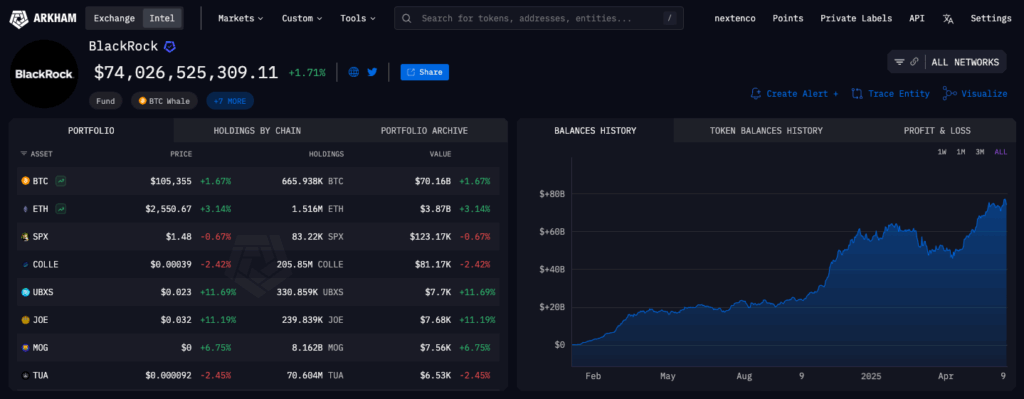

During the peak of the “Ethereum is dead” narrative, BlackRock increased its ETH holdings by $1 billion, jumping from $3.2B to $4.2B in just a few weeks. Even more striking? They reportedly sold $500 million in Bitcoin to rotate into Ethereum.

This is classic institutional behavior:

Say one thing. Do another.

And it’s all part of a broader market cycle known to seasoned crypto investors as the “Great Crypto Rotation.”

Here’s how it usually plays out:

- Bitcoin breaks all-time highs.

- Ethereum follows and dominates.

- Top altcoins pump.

- Then the real altseason begins as mid- and low-cap tokens explode.

BlackRock’s portfolio moves suggest they believe we’re on the edge of Phase Two.

🧠 The 3 Pillars of the 3% Club

So how do you win this war?

How do you protect your capital and play offense with confidence?

Pillar 1: Watch Their Hands, Not Their Mouths

Don’t trust what institutions say. Trust what they do.

They’ll warn you about ETH’s risks while accumulating billions behind the scenes. And no, this isn’t a fakeout for those watching their wallets—because 97% of retail traders don’t know how to track wallets in the first place.

📌 Lesson: Focus on on-chain analytics and institutional positioning—not influencer FUD or media narratives.

Pillar 2: Fight Back with Data

Retail traders consistently buy hype and sell fear. Why? Because they rely on emotions—not data.

That’s where CoinStats changes the game.

Unlike generic fear-and-greed indices that track Bitcoin alone, CoinStats shows sentiment scores for individual altcoins like SOL, ETH, SUI, and Worldcoin.

Example:

- Worldcoin at $4 in December 2024: Sentiment score = extreme greed → result: hard dump

- Worldcoin at $0.50 in May 2025: Sentiment score = extreme fear → result: nearly 3X pump

📌 Lesson: Extreme fear = smart accumulation zone. Use sentiment data to make objective decisions—not emotional ones.

Pillar 3: Break Their Patterns, Break Their Control

Institutions profit from confusion.

They know retail investors rely on patterns—so they break them.

- Q1 is usually bullish post-halving. In 2025? It was bearish.

- “Sell in May and go away” usually holds. In 2025? May was explosively bullish.

📌 Lesson: If the crowd expects bullishness, prepare for bearish chop. If they expect disaster, stay ready for a reversal.

And if you find yourself overwhelmed by narratives and noise, here’s the antidote:

Disconnect.

Step away from crypto Twitter. Spend 72 hours without market hype. Recalibrate. Then plug into a community focused on truth over trend.

🔒 Final Thoughts: You Now Have the Playbook

You’re not crazy. The market is being manipulated.

But now, you’re not blind to it.

You’ve got the tools. You’ve got the mindset.

You’ve got the playbook:

✅ Watch their actions—not their headlines

✅ Use sentiment data to guide conviction

✅ Defy the patterns that manipulate the masses

You are now on the path to joining the 3% Club—those who win, who build, and who don’t hand over their wealth to the same institutions that once laughed at crypto.

Want to Go Deeper?

Join our free Patreon & Telegram communities, where we talk strategies, analyze sentiment, and support each other in real time.

This is the 3% Club. We research. We prepare. We don’t panic.