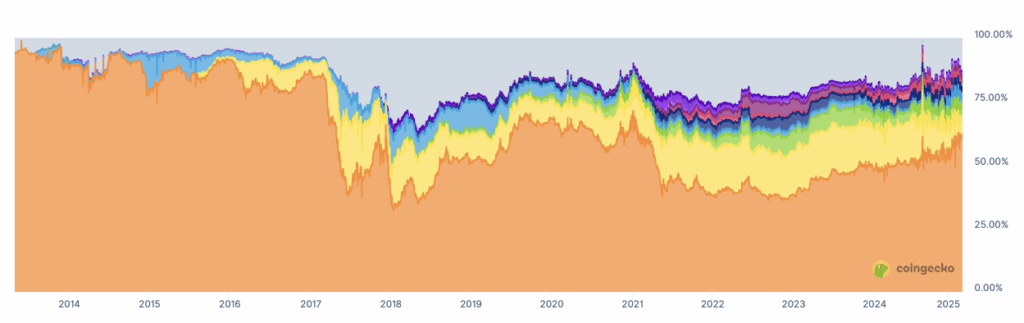

Bitcoin has crossed the $100,000 mark for the third time in its history, hitting the milestone on May 8 at 3:22 p.m. UTC with a 4.2% intraday surge from a low of $95,967, according to CoinGecko data. The spike signals renewed bullish momentum and comes as Bitcoin’s market dominance surged past 60% — the highest level since early 2021.

This new high differs from previous breakthroughs in December 2024 and January 2025, where Bitcoin’s dominance stood at 52% and 54%, respectively. The rising dominance suggests investors are increasingly favoring Bitcoin over altcoins.

“Bitcoin has been demonstrating remarkable strength, outperforming altcoins and showing resilience against global geopolitical uncertainties,” said Petr Kozyakov, CEO of Mercuryo.

“Combined with gold’s strong performance, Bitcoin is cementing its role as a long-term economic hedge”

The recent rally is being driven by a combination of macroeconomic and political developments. Notably, former President Donald Trump hinted at a potential US–UK trade deal via Truth Social on May 7, a move that many in the crypto community link to the price surge.

Vincent Liu, CIO at Kronos Research, pointed to institutional inflows into spot Bitcoin ETFs — totaling $1.8 billion in the past week — along with declining bond yields and a weakening US dollar as key contributing factors. “Bitcoin hovering near $100K is a reflection of both investor confidence and broader macro support,” Liu said.

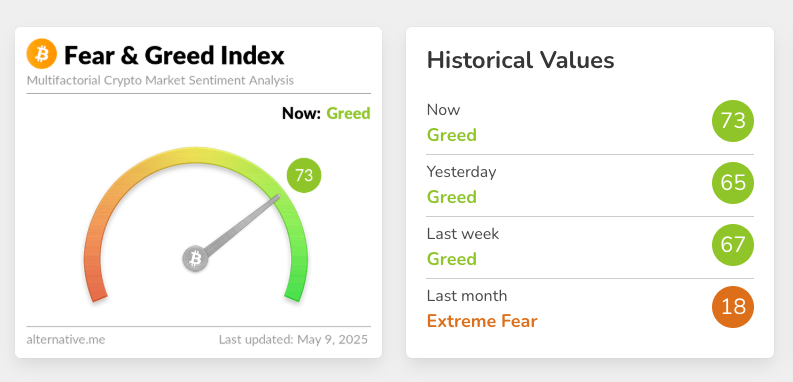

However, market analysts remain cautiously optimistic. The Crypto Fear & Greed Index currently holds at 73, indicating moderate bullish sentiment, but upcoming U.S. economic reports — including budget data on May 12 and CPI figures on May 13 — could play a critical role in determining if Bitcoin can sustain this rally.

According to Ben Caselin, CMO at VALR, there’s a strong chance Bitcoin could breach new highs above $110,000. “Retail investors typically enter during the final stage of the four-year Bitcoin cycle. If this trend holds, a macro top could form in Q4 2025,” he noted, adding that continued regulatory progress and institutional adoption may support long-term growth beyond this cycle.